Small business bookkeeping doesn’t mean that we can’t apply the same strategies that large corporations use. In my 15 years with companies like Cameron, Schlumberger and Westlake, we utilized an accounting practice that you may not be too familiar with: Statistical accounting.

How Comprehensive Bookkeeping Provides Financial Stability for Independent Contractors

James Dodd, MBA, EA

Statistical Accounting

Statistical accounting is the use of non-financial data in your general ledger which is used to create deeper insights into what your finances mean, and something your current bookkeeping services are most likely not using. Here’s a quick example to demonstrate the concept:

Roofing Job with Statistical Accounting

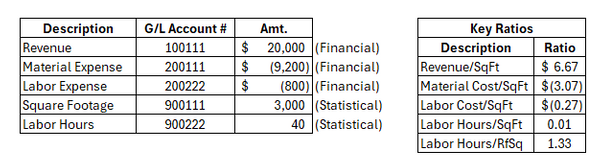

A roofer installs a new roof for $20,000, and let’s say the roof is 3,000 square feet, so 30 roof squares. Let’s assume it took 40 man-hours, and the labor cost was $20/hr, so $800 in labor total and let’s put the materials cost at $9,200 just to make a nice even cost of goods sold for the example.

a. Your bookkeeper has put in revenue of $20k, materials expense of $9.2k and labor expense of $.8k for a total profit of $10k. At any given time, you can quickly and instantly see your revenue, expenses and profit.

b. Now let’s try this with statistical accounting. You’ve hired Dodd Financial for your bookkeeping services, the experts in utilizing statistical accounting, and we give you this:

The Game Changer

Imagine now having a month, a quarter, a year, multiple years of this data and being able to quickly and easily determine the cost per square foot of any job, using any material, quickly and accurately. What kind of strategic decisions could you be making by implementing this practice into your books? Small business bookkeeping should be performed with big business strategies if they apply! Don’t settle for your average, every day standard bookkeeping services, turn your financial statements and data into tools to make your next major strategic decision.